Starting is Simple!

Whether you’re new to tax preparation or have a little bit of knowledge, we have a course for you.

English Tax Training

Bilingual Tax Training

Spanish Tax Training

Benefits of becoming a Tax Professional

A tax preparer can decide how many clients they want to take on and when they want to work. While tax season is typically busy, it only lasts a few months of the year. You can spend the rest of the year vacationing, or you can learn other related skills such as bookkeeping and financial planning, to stay busy year-round.

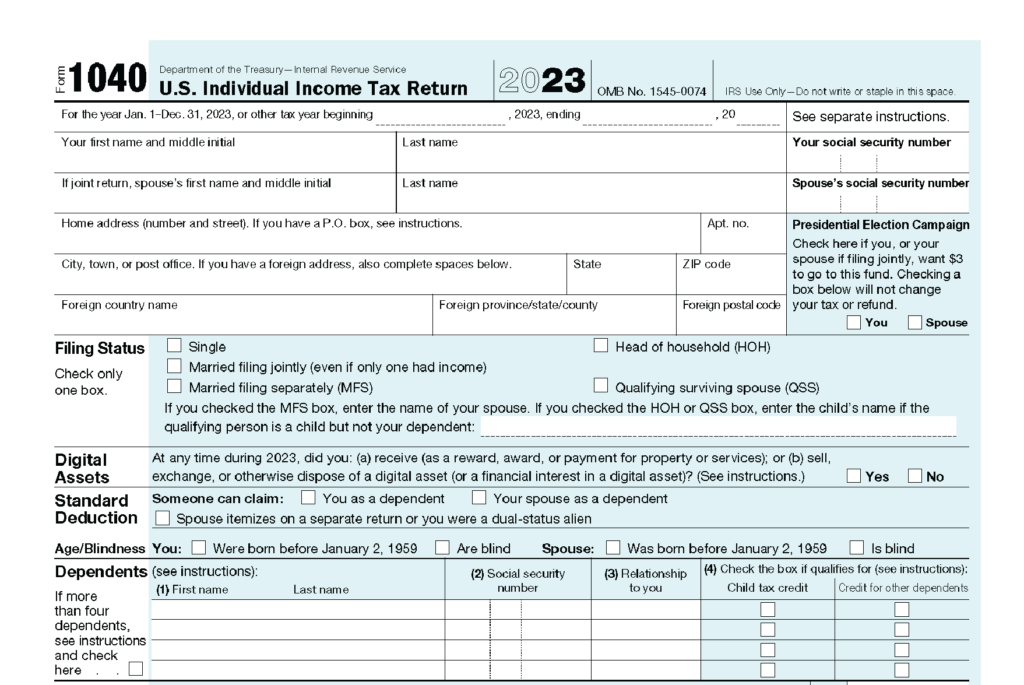

FEDERAL BEGINNER COURSE

Our Tax Preparation Course is designed to give you the knowledge needed to fulfill IRS requirements and give you a basic understanding of tax law and practice to ensure you serve your clients with the highest quality. This study material has been organized to give line-by-line instructions for Form 1040.

CALIFORNIA QUALIFYING COURSE

This course meets the 60-hour Qualifying Education requirement (45 hours of Federal Tax Law, which includes the required 2 hours of Ethics and 15 hours of California Tax Law) imposed by the state of California (CTEC) to become a California Registered Tax Preparer.

RENEWING TAX PROS

Select your course to get the latest updates! If you’re from California choose the 20 Hour course.

BUNDLE AND SAVE

The Continuing Education bundle is ideal for EAs or CPAs that want to fulfill their requirements.

The Bookkeeping bundle is a basic introduction to bookkeeping.

Start your own tax school

Do you need to make extra income after tax season?

Become an instructor to teach seasonal staff or help others start a new career. We will provide all of the tools you need to get started.